Guide to NetSuite Account Reconciliation for Financial Process Efficiency

As organizations grow and evolve, financial management becomes a more complex task. Traditional, manual ways of managing accounts and reconciliations...

10 min read

Cumula 3

:

Jan 1, 2021 10:27:00 AM

Cumula 3

:

Jan 1, 2021 10:27:00 AM

Let me guess, your organization has embarked on an ERP initiative, and NetSuite is at the top of your list.

Am I right?

If you said yes, you're in good company!

There are literally hundreds if not thousands of Google searches per month of people just like you searching for information on phrases like "NetSuite Competitors", "NetSuite vs..." or "ERP Alternatives", etc. you get the idea. In fact, understanding the landscape of competitors of NetSuite is crucial in making an informed decision for your ERP needs.

To further illustrate this point, according to Gartner, ERP software happens to be the largest category of enterprise software spending at a staggering $31.4 billion and growing at 7% per year!

The bottom line, everyone is moving their business applications to the cloud!

Now, if you are just starting your research, you will quickly see there's no shortage of options and opinions when looking to replace your existing accounting systems. Last I checked, there were rough ~50+ ERP / Financial Management applications available to license, granted many of them serve a specific niche industry.

That being said, within the SMB and Mid-Market space (defined 1-1000 employees), there are only a handful of serious software vendors to consider. These include SAP, Oracle+NetSuite, Microsoft, Salesforce, Infor and Sage. And each of these software vendors has a handful of ERP options to choose from.

The NetSuite Competitors Guide below represents the most commonly seen ERP and Financial Management systems that directly compete with NetSuite head-to-head or are often replaced by NetSuite.

While this post is full of great information, it is intentionally limited. If you want the full NetSuite Competitors Guide, you will need to download it. It's just too big to publish in a blog format.

Bookmark this page and use the links below to jump around as you continue to explore NetSuite alternatives.

Table of Contents

|

Overview: |

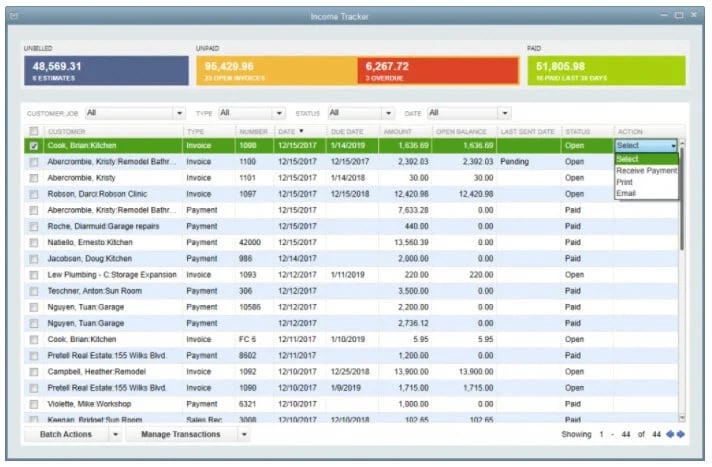

Often the go-to financial management software for startups and small businesses, Intuit’s QuickBooks offers a range of features designed to manage the early needs of a small business, such as payroll, sales, inventory, and other needs. |

Best Fit for: |

Small businesses or startups with no subsidiaries or global needs in the following areas: manufacturing, wholesale, professional service firms, contractors, non-profit entities, and retailers. |

NetSuite vs. QuickBooks: |

● NetSuite supports multi-language, multi-currency, multi-subsidiary consolidation and other complex accounting functions, such as fixed assets, multi-book accounting, recurring billing, revenue recognition, and more. QuickBooks does not. ● While QuickBooks focuses exclusively on accounting, NetSuite is a complete business suite. ● Unlike the QuickBooks-required software installation, NetSuite is deployed as web-based software.

|

|

|

|

Overview: |

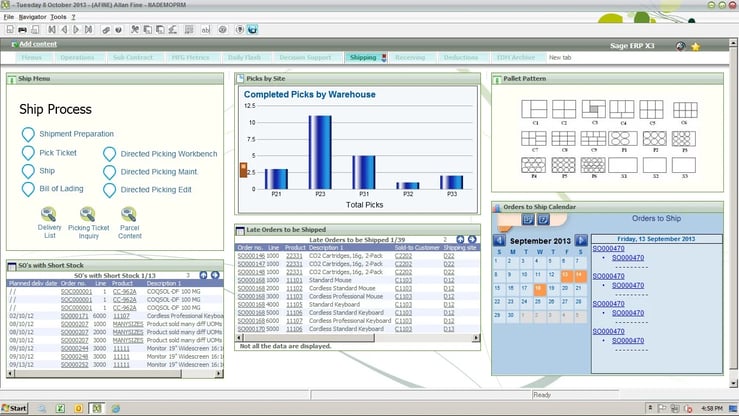

Sage was founded in 1981 as an estimating and financial management software for the small business space, which it still targets today. Based in Newcastle, UK, the company has a global presence in 24 countries and can attribute most of its growth through acquisitions. |

Best Fit for: |

Although Sage does target small businesses as a general rule, Sage X3 is best positioned to serve the manufacturing industry. Process manufacturing can benefit from its batch processing and formula/receipt management capabilities. Sage also offers discrete manufacturing functionality for make-to-stock, make-to-order, and demand planning, along with flexible pricing and inventory management. |

NetSuite vs. Sage X3: |

● Sage will require more manual processes and is less accurate than NetSuite due to multiple ledgers and multiple charts of accounts. ● Sage does not support extensive customizations and may require customers needing heavy customizations to utilize Amazon Web Services for hosting. ● In Sage, budgets are often not in alignment with financials.

|

Overview: |

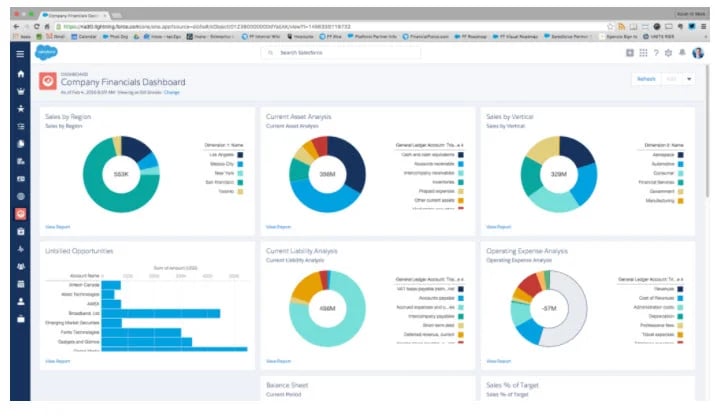

SalesForce and Unit 4 developed FinancialForce (FF) in 2009 as an ERP product for its SFDC customers. Based in San Francisco, CA, SalesForce is a global enterprise heavily funded by venture capital. |

Best Fit for: |

SFDC customers that are accustomed to the platform or who have developed extensive customizations on Force.com. FinancialForce also caters heavily to professional service organizations and customers in North America. |

NetSuite vs. FinancialForce: |

● FF is not a complete ERP solution, while NetSuite is. Furthermore, FF is not a global solution and is only available in English. ● When using FF PSA, any complex processes require customization, such as resource management and Rev Rec. ● Reporting is limited on FF, while NetSuite offers extensive and real-time reporting.

|

Overview: |

Intacct was founded in 1999 to provide customers with an online alternative to on-premise financial management software. Intacct was recently acquired by Sage in July 2017 for $850 Million. |

Best Fit for: |

Intacct serves small to medium companies in software, services, and nonprofit industries looking only to manage their financial functions. |

Sage Intacct vs. NetSuite: |

● While the cost of licensing Intacct is lower than NetSuite, customers are limited to financial capabilities, therefore limiting value over time. Intacct is not considered a true ERP system for this reason. NetSuite is a full-service ERP system. ● Intacct is not scalable to the enterprise level, which could stifle its high-growth customers. NetSuite’s customer base includes both small businesses and large enterprises and provides the flexibility to shift when business needs evolve. ● Reporting functionality can be difficult to use in Intacct, whereas NetSuite provides over 200 financial reports that can be configured out of the box, with point and click customizations.

|

Overview: |

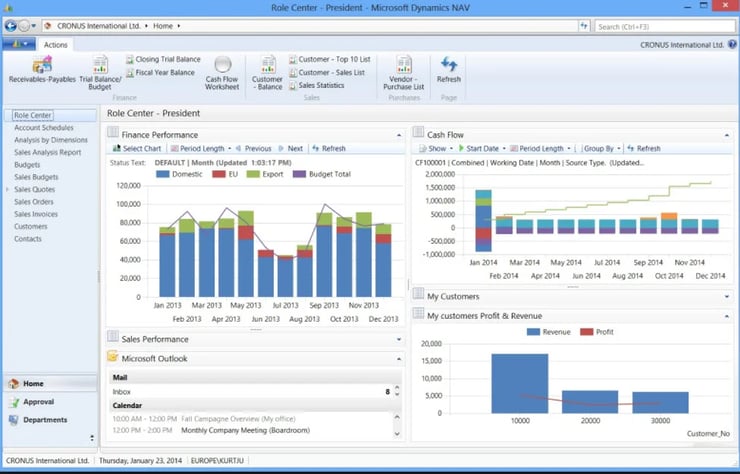

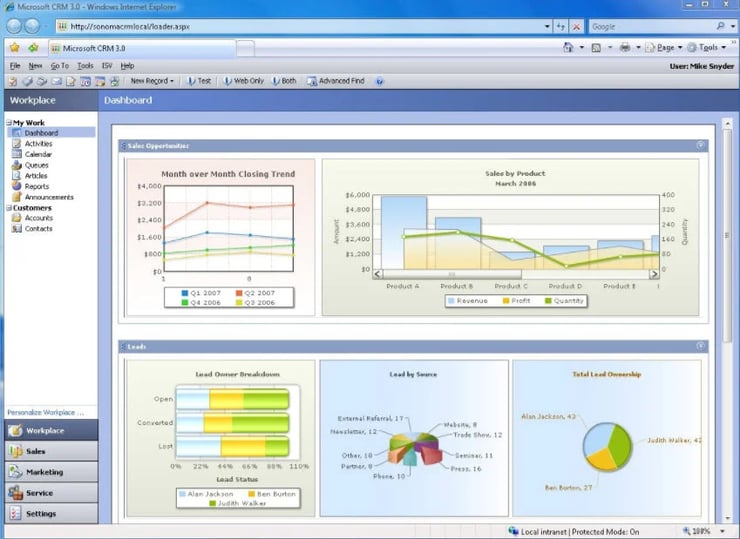

What is now known as “NAV” began as a Denmark-based startup in 1984. In 2002, Microsoft acquired the company, which provides a global ERP system to small to medium-sized businesses. |

Best Fit for: |

NAV is popular among wholesale distribution and manufacturing companies, which comprise the bulk of its customer base. Due to its similar aesthetic to Microsoft Office, customers with Office dependencies often find NAV an appealing option. |

NetSuite vs. Navision: |

● With NAV, upgrades can be complex and challenging, whereas NetSuite completes all upgrades automatically. ● NAV is not a true multi-tenant SaaS product, whereas NetSuite is. ● There is a great deal of uncertainty around NAV’s implementation costs, whereas NetSuite can provide a fixed bid.

|

Overview: |

Microsoft Dynamics Great Plains (GP) is a mid-market accounting solution serving customers internationally. GP was originally created in the early 1990s and is the first Windows-based accounting offering. |

Best Fit for: |

Companies working within Consumer Packaged Goods, Distribution, High Tech, and Discrete Manufacturing who are heavy users of Microsoft products. |

NetSuite vs. Great Plains: |

● GP is an on-premise software, while NetSuite is a true SaaS solution. This translates to cost saving over time for NetSuite customers, as upgrades and implementation are automated and/or easy to implement. ● While GP does not make it easy for companies to scale as their needs change, NetSuite offers a highly flexible and configurable environment where changes can be made quickly and easily.

|

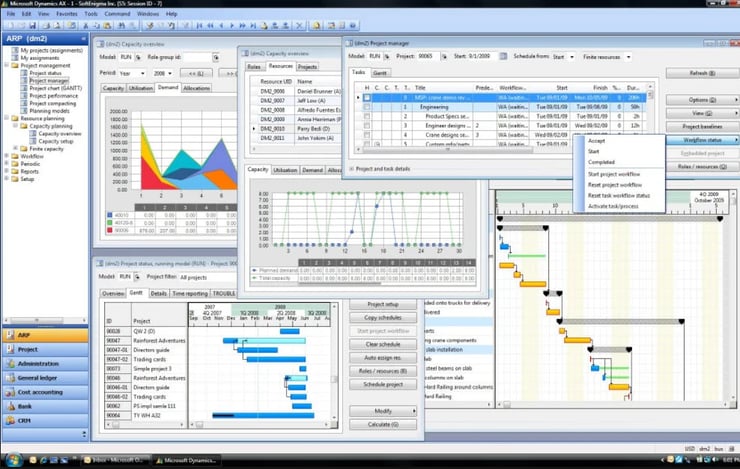

Overview: |

Microsoft Dynamics AX began as a database and programming tool for the enterprise and evolved to offer ERP through several acquisitions. |

Best Fit for: |

AX was built for enterprise-level customers in manufacturing, distribution, the public sector, retail, and services. |

NetSuite vs. AX: |

● NetSuite’s SaaS model offers a multi-tenant architecture; AX does not, with each deployment running on isolated infrastructure, even though the Azure platform is multitenant. ● NetSuite offers a quick deployment, whereas AX’s deployment process is lengthy.

|

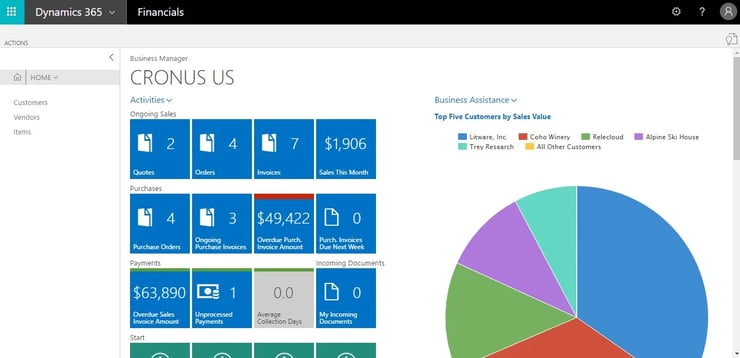

Overview: |

Microsoft has been offering legacy Dynamics ERP solutions for over 15 years with SL, GP, NAV and AX. In 2012, Microsoft tried offering hosted versions (Azure-focused) of each product through partners, however not all were successful. Customers bought multiple iterations of AX Cloud but failed to go live and work with various customers. To streamline the product portfolio and further secure the Microsoft stack, Dynamics 365 was announced. 365 is Microsoft’s attempt to revolutionize how they interact with customers by providing a holistic integrated Microsoft solution that supports an entire customer’s end-to-end processes. From Office 365, PowerBI, Cortona Intelligence, Azure Intelligent Cloud, Azure IOT Platform and older Sunrise Industry Apps, customers have access to the entire MSFT through one holistic solution |

Best Fit for: |

365 Enterprise Edition (365 EE) was purpose-built for Manufacturing, Distribution, Public Sector, Retail and Services for 250+ users. There is a Small Business Edition for companies with less than 250 users. |

NetSuite vs. Dynamics 365: |

● Product simplicity. 365 is too big & difficult for partners to propose the right configuration & tough for customers to understand what is critical. ● NetSuite provides native integration for many capabilities like Mobile, CRM and BI. ● 365 requires a separate technology stack needed to run BI, Mobile, and CRM.

|

Overview: |

NetSuite ERP and Microsoft Dynamics 365 Business Central are both enterprise resource planning (ERP) solutions designed to help businesses manage their operations more efficiently. However, they have some key differences that may make one option the better choice for your company. Microsoft Dynamics 365 Business Central (BC) is an immature yet evolving, inexpensive yet robust ERP solution which offers broad functionality for the SMB market. It is a single tenant cloud solution which was re-architected from Microsoft Navision (NAV), a legacy ERP originally designed for on-premise deployments. BC is a siloed solution and has limited consolidation capabilities, expensive customizations and weak reporting capabilities. NetSuite is a less risky choice, leading cloud-based ERP sector for several years. D365 BC is a relatively new cloud product (re-architected from NAV) that lacks pure cloud heritage. NetSuite is a solid, low-risk, proven solution, chosen by over 24k customers worldwide compared to D365 BC’s estimated 10k customers. |

Best Fit for: |

Lower end of the SMB marketing looking to migrate off of QuickBooks or GreatPlains desiring greater financial and inventory management capabilities from a cloud-based ERP that can scale without breaking the budget. |

NetSuite vs. Business Central: |

● Consolidations & Intercompany Processes. D365 BC is very manual and based on journal entries

● Business Central does not natively have solutions for Subscription Billing, Payroll, Revenue Recognition.

● Scalability. Customers easily grow and scale with NetSuite (IPO, M&A, International, Vertical Growth, etc.).

|

Overview: |

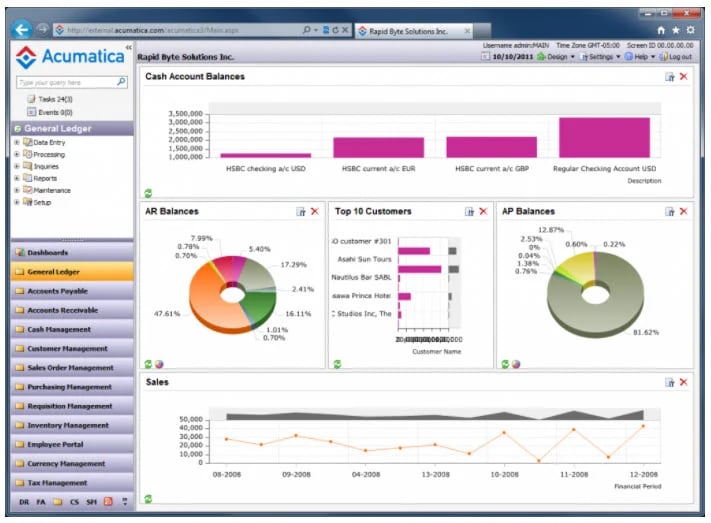

Privately held Acumatica appeals to smaller customers as it charges by transactional volume, not per user. However, this may become a weakness as the customer's scale. Acumatica allows its customers to switch between a fully managed SaaS solution and a traditional on-premise solution (install and manage on their own or by a partner). |

Best Fit for: |

The SMB market requires deeper functionality (than a typical QuickBooks), more flexibility, decision support and options for integration and customization. $20-50M in revenue/50-500 employee range. |

NetSuite vs. Acumatica: |

● Acumatica offers limited functionality – offers a little bit of everything, but not a lot of anything of depth. Not well ranked on Gartner's MQ, whereas NetSuite scored "leader" title. ● Acumatica claims they have a CRM offering, but it’s more like a contact management system. No match for NetSuite's CRM breadth. ● Acumatica reporting requires sophisticated programming knowledge – even then, minor changes are tough. NetSuite's reporting engine is considered the best in class providing users with real-time insights.

|

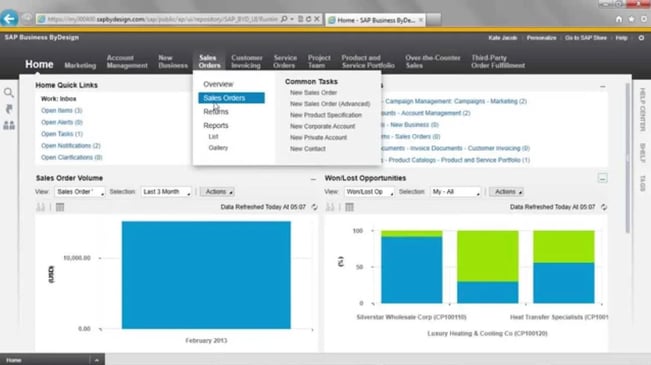

Overview: |

ByD is SAP’s first organic cloud ERP (~$1-2B+ investment). It was released in 2007 and pulled back a few months later for re-tooling. It was re-released in 2008 with a focus on mid-market Professional Services, Wholesale Distribution and Manufacturing. |

Best Fit for: |

Current SAP customers wish to deploy an integrated solution to subsidiaries that is more agile and cost-effective than ECC or S/4HANA. ByD is strong in manufacturing, supply chain (i.e.. retail and WD), and professional services/projects (i.e.. consulting, field services and repair) |

NetSuite vs. ByD: |

|

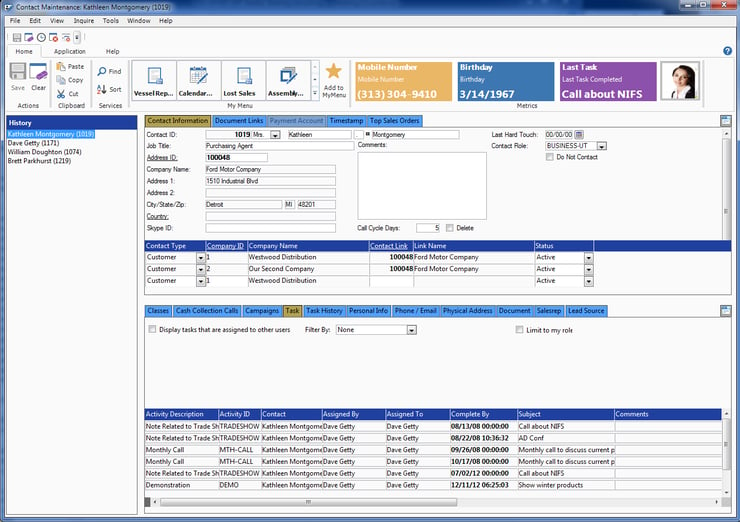

Overview: |

SAP Business One was initially launched in Israel in 1996 under the name TopManage. SAP acquired TopManage financial management software in 2002 and rebranded it as SAP Business One. The acquisition allowed SAP to reach out to the midmarket through its partners and also to gain additional business from the smaller subsidiaries of its enterprise customers. SAP B1 is a client-server model software product that is Microsoft Windows-based and connects to a back-end server; also offered on iOS and Android devices with a subset of the full features. SAP B1 can be hosted or managed on either a Microsoft SQL Server database (Windows) or SAP HANA database (Linux). |

Best Fit for: |

SAP Business One has strong functionality and is a great fit for its original niche market segment. More recently, Business One is sold into the mid-market and going directly up against NetSuite’s core market. SAP claims Business One is better integrated with other SAP products and is sold to fill gaps (acquisitions, subsidiaries, new business models). |

NetSuite vs. SAP Business One: |

● No native support for multi-company - requires multiple instances of the solution (no financial consolidation). ● SAP Business One is not a multi-tenant solution and is hosted by certified SAP partners; users still need a remote access client. ● SAP Business One may have performance issues with over 50 users. ● SAP Business One Licensing cost is significantly less expensive than NetSuite.

|

Overview: |

Epicor was initially founded in 1972 and headquartered in Austin, TX. Currently a privately held company with over 4,000 employees and 20,000 customers across 15+ products. Most of Epicor's customers are based in North America but have a presence in ~150 countries via partners. Historically, Epicor's sweet spots have been with complex manufacturing and wholesale distributors located in North America. |

Best Fit for: |

Epicor 10 is a solid fit for complex manufacturers looking for choices in deployment models (on-premise vs. cloud). Especially companies looking for a migration path to the cloud. Companies needing to support batch, process and discrete manufacturing with strong production, inventory and warehouse management capabilities will find Epicor appealing. |

NetSuite vs. Epicor 10: |

|

Overview: |

IFS is a European-based ERP software provider. Recently acquired by EQT venture capital firm and making a big push into North America. Recently retooled its ERP system for the cloud and claims over 4,000 customers in 30+ countries. |

Best Fit for: |

Complex manufacturing companies within the 100M to 5B revenue range. IFS is also a solid contender for business with field service management and requires enterprise asset management solutions. |

NetSuite vs. IFS: |

● NetSuite has a more robust partner and ISV network making it much easier to find consultants and solutions that are plug and play for NetSuite. It's really hard to find IFS-certified consultants. There are only a handful of partners in North America. ● While there is some overlap between the two systems, IFS tends to go after companies within the 100 million and 5 billion revenue range, whereas NetSuite tends to compete in the 10 million to 500 million revenue range. ● SMB - MME discrete manufacturing companies with limited complexity looking to modernize their IT infrastructure will likely favor NetSuite, whereas large complex manufacturing companies that also need Enterprise Assessment and Field Service Management capabilities will likely favor IFS.

|

As organizations grow and evolve, financial management becomes a more complex task. Traditional, manual ways of managing accounts and reconciliations...

Cumula 3 Group is proud to announce its appearance on the prestigious Accounting Today's VAR 100 list for 2023. This notable directory highlights...

Cumula 3 Group Marks Its First Appearance in Bob Scott's Top 100 VARs for 2023 The esteemed Cumula 3 Group is proud to announce its debut on Bob...