As organizations grow and evolve, financial management becomes a more complex task. Traditional, manual ways of managing accounts and reconciliations often fall short, causing errors and inefficiencies that can impact financial accuracy and business decision-making. This is where the innovative solution NetSuite Account Reconciliation (NSAR) comes into play, offering a powerful, automated way to streamline account reconciliation processes for NetSuite users.

The latest addition to the NetSuite cloud ERP suite is the NetSuite Account Reconciliation. This tool aims to declutter reconciliation procedures, thereby strengthening financial controls, producing more precise financial statements, and enabling a quicker close.

Gary Wiessinger, Senior VP of NetSuite Application Development at Oracle, explains, “General ledger reconciliation can be one of the most complex aspects of the financial close and poses a risk to compliance.” With NetSuite Account Reconciliation, Oracle NetSuite brings enterprise-grade technology to help simplify this critical process.

This solution expands the suite’s capabilities to enhance efficiency, ensure completeness and accuracy of financial statements, and extract more value from NetSuite.

NetSuite Account Reconciliation, built on Oracle Fusion Cloud Enterprise Performance Management (EPM), introduces automation in reconciliation for accounts payable, accounts receivable, bank and credit card transactions, prepaid accounts, accruals, fixed assets accounts, intercompany transactions, and other balance sheet accounts.

Want smoother financial close cycles? Get custom NetSuite pricing and guidance to improve reconciliation efficiency.

Introduction to NetSuite Account Reconciliation

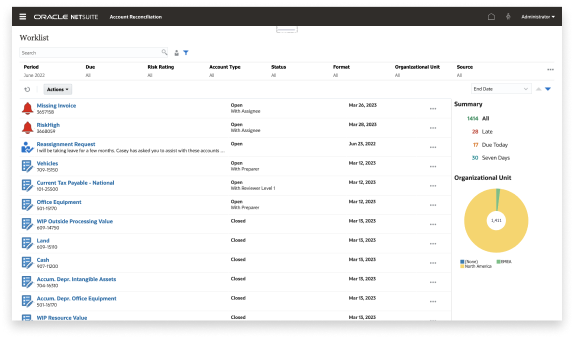

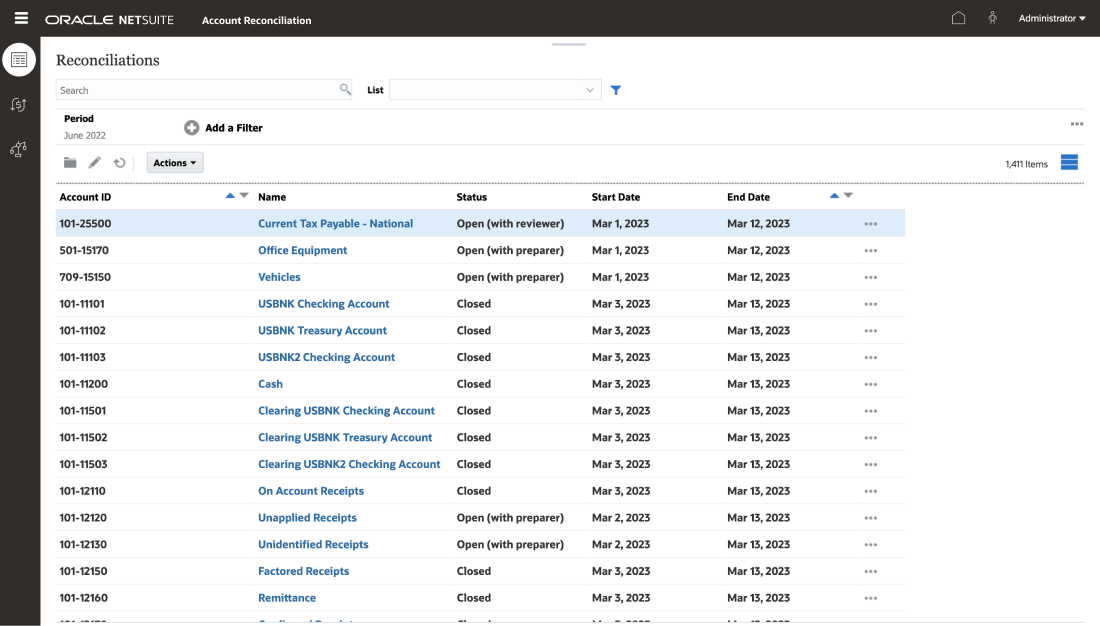

NetSuite Account Reconciliation (NSAR) is a novel offering that fully automates general ledger account reconciliations, including bank reconciliations, credit card matching, intercompany transactions, account receivables and payables, and invoice-to-PO matching. This centralized workspace removes the need for manual ticking and tying, enabling accounting teams to focus on exceptions, high-risk reconciliations, and strategic work.

Before the arrival of NSAR, companies – especially those transitioning from simpler systems like QuickBooks – often expressed surprise that a full-blown ERP like NetSuite lacked in-built account reconciliation capabilities. The new NSAR add-on is set to address this gap, bringing more powerful account reconciliation functionality directly into NetSuite.

Top Benefits of NetSuite Account Reconciliation (NSAR)

NetSuite Account Reconciliation brings a host of transformative features to the table, starting with seamless integration. Thanks to the in-built synergy between NetSuite ERP and NetSuite Account Reconciliation, accounting teams have quick, secure access to NetSuite general ledger data, thus paving the way for efficient reconciliation. As a result, manual transaction entry becomes a thing of the past, freeing up time for data analysis and insights that can catalyze informed, timely decision-making.

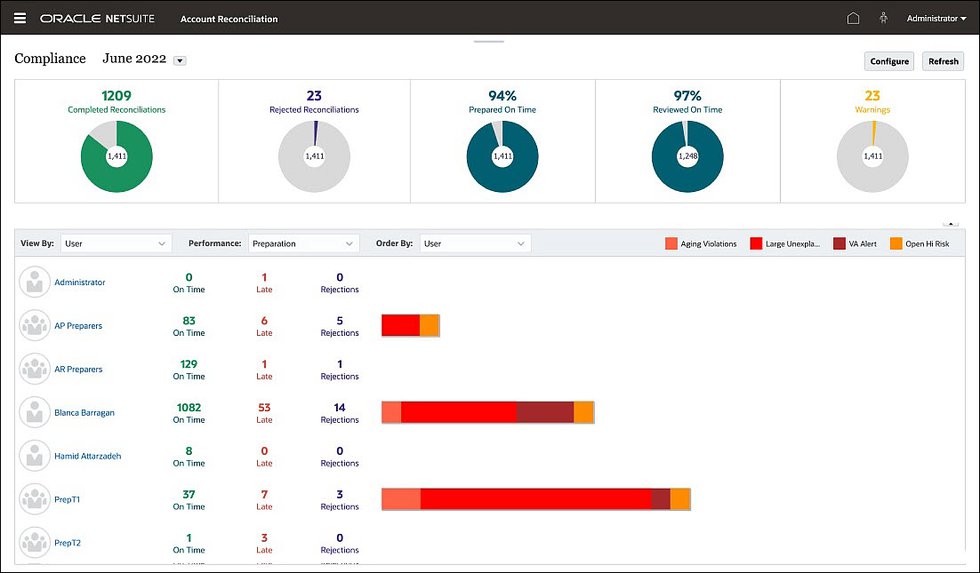

Further aiding the process, the software offers 20 prebuilt reconciliation templates and formats. These resources expedite the reconciliation procedure, promoting consistency and thereby enhancing the precision of financial reporting. Adding to these benefits, NetSuite Account Reconciliation also features a robust transaction matching engine that enables accounting teams to match millions of transactions within minutes. By cutting down on time and errors, and by integrating directly with period-end reconciliations, it substantially speeds up the financial closing process. Additionally, a secure document repository provides a safe haven for reconciliations, guarding them against any alterations or loss. This feature not only ensures compliance but also facilitates global audits, further bolstering the software’s utility.

- Improved Financial Statement Accuracy: By reconciling General Ledger (GL) accounts, NSAR identifies discrepancies or omissions in financial records, reducing the risk of financial misstatements.

- Strengthened Internal Controls and SOX Compliance: NSAR makes archived electronic copies of supporting documents easily accessible at the account level, strengthening internal controls and ensuring SOX compliance.

- Faster Close Process: NSAR standardizes and automates account reconciliations and transaction matching, enabling a faster financial close process.

- Speedy Transaction Matching: The software automates time-consuming reconciliations like zero-balance, low-value, or low-risk reconciliations according to user-set rules, speeding up transaction matching.

- Single, Consolidated Solution: NSAR provides a unified platform to manage and view the status and specifics of each account, including balance comparisons, preparers, reviewers, and sign-off dates.

Comparative Review: NSAR vs Alternatives

When assessing the effectiveness and efficiency of account reconciliation solutions, it’s vital to compare them side-by-side. Here, we dive deeper into how NSAR compares with popular 3rd party solutions like BlackLine and FloQast.

NSAR and BlackLine: A Detailed Comparison

BlackLine has been a leader in account reconciliation and financial close solutions for over two decades. However, when we juxtapose NSAR and BlackLine, NSAR’s distinctive advantages become apparent.

- Native Integration with NetSuite ERP: Unlike BlackLine, NSAR offers native integration with NetSuite ERP. This compatibility simplifies processes, as businesses do not have to worry about integrating third-party solutions with their existing systems.

- Cost-Effectiveness: NSAR provides a more cost-effective solution than BlackLine, giving businesses access to robust features and functionalities without straining their budgets.

- Faster Implementation: The time taken to implement NSAR is shorter than that of BlackLine. Faster implementation means businesses can start benefiting from automated account reconciliation sooner.

- More Reconciliation Templates: NSAR offers more reconciliation templates than BlackLine. These templates can be customized to fit the specific needs of a business, ensuring greater flexibility and adaptability.

- Unlimited Storage: NSAR offers unlimited storage, a feature that BlackLine does not provide. This allows businesses to store and access their reconciliation data without worrying about running out of storage space.

Evaluating NSAR vs FloQast: What You Need to Know

FloQast, primarily known for its month-end close solution, differs significantly from NSAR in several ways:

- Dependence on Excel: FloQast heavily relies on Excel, requiring manual effort for accuracy. NSAR, in contrast, offers a unified platform with automated workflows, eliminating the need for time-consuming and error-prone manual tasks.

- Modularity vs. Unified Platform: FloQast offers a modular solution, which might not be as seamless as the unified platform offered by NSAR. This can create discrepancies in the reconciliation process and hinder the overall efficiency.

- Multi-Subsidiary Support: NSAR provides multi-subsidiary support, enabling businesses with multiple branches or subsidiaries to manage their account reconciliations more efficiently. FloQast does not offer the same level of support.

- Journal Entry Capabilities: NSAR boasts journal entry capabilities, allowing businesses to keep track of their financial transactions effectively. FloQast does not offer this feature, which can limit its usefulness for certain businesses.

Pricing & Versions of NSAR: In-Depth Analysis

Understanding the nuances of investing in a tool like NSAR is critical to ensure the best fit for your business. With a diverse array of needs and budgets in mind, NetSuite has thoughtfully crafted two distinct versions of NSAR – the Standard and the Premium.

The Standard version is an excellent choice for businesses looking to digitize and streamline their basic account reconciliation processes. It is designed to be financially accessible, providing all the essential features necessary for efficient account reconciliation. The cost is determined annually and includes an affordable per-user fee, with a minimum requirement of five users.

If your business necessitates a more extensive set of features, the Premium version is a compelling upgrade. It offers a broader range of tools and functionalities that allow a greater level of control and automation in your account reconciliation processes. Similar to the Standard version, the Premium version has an annual cost and an equally reasonable per-user fee, with a minimum of five users needed.

It’s noteworthy to mention that these pricing models cover the software subscription exclusively. The provision of implementation services that ensure seamless integration of the software into your unique business model warrants an additional investment. Such services encompass training, customization, and support during the transition phase. At present, due to the innovative nature of NSAR, these services are exclusively delivered by NetSuite Professional Services.

To unlock pricing for NSAR please contact Cumula 3 Group to learn more.

Availability of NSAR: What’s New

The launch of NetSuite Account Reconciliation is scheduled to happen in stages. The first phase of availability is set for North America, with the software slated to be released in this region in June 2023. The software’s power and convenience have already garnered significant anticipation among businesses looking to streamline their financial processes.

But the software’s reach isn’t limited to North America. Following the initial North American release, NetSuite has plans to expand the availability of Account Reconciliation to international regions. The roll-out to these global markets is expected to commence from the third quarter (Q3) of 2023. This strategic phased launch will allow NetSuite to extend the benefits of its Account Reconciliation software to businesses worldwide, helping them enhance their account reconciliation processes irrespective of their geographical location.

Summing Up: The Impact of NSAR on Financial Efficiency

As businesses grow and their financial processes become more complex, solutions like NSAR are essential to ensure financial accuracy and operational efficiency. By offering a cost-effective, unified platform with robust features, NSAR stands out as a compelling choice for NetSuite users. With its strong competitive advantages over alternative solutions, the benefits of NSAR are clear. So, why wait? Get in touch with us to schedule your NSAR demo today and take the first step towards transforming your account reconciliation process.

Ready to make account reconciliation faster and more accurate? Start with a tailored pricing estimate and expert support from Cumula 3 Group.