Making Your Decision: NetSuite or Business Central?

Choosing between top enterprise resource planning (ERP) systems like NetSuite and Business Central can significantly impact a business's efficiency.

When choosing the right business management software, it's important to consider a variety of factors, including cost, scalability, user-friendliness and integration capabilities. Two popular choices are NetSuite and Intacct, which on the surface appear very similar. Both platforms enable organizations to manage financials, order management, customer support and more. And both offer cloud-based solutions for streamlining operations and making them accessible from anywhere. However, deeper analysis reveals some subtle but important differences between the two platforms that can help you make an informed decision about which is best suited for your organization.

I'm going to compare and contrast NetSuite against Intacct in great detail, in areas that are often overlooked during the sales process.

In short: if you want a single online resource to help you during your ERP evaluation this should be the one.

Let's get started.

For growing businesses, there is an important decision to make when choosing a new ERP system: Best-of-Breed or Business Suite?

The first question you should be asking yourself is, are you looking for a stand-alone financial management application, or are you looking to run your entire business from a single suite of business applications?

Intacct is focused exclusively on financial management and is considered a “best-of-breed” financial solution, since this is all they do.

Whereas NetSuite’s offerings span well beyond the needs of accounting and finance. For instance, NetSuite offers the following applications/modules you can include at any time throughout the duration of your NetSuite subscription.

Keep in mind that while NetSuite offers a broad suite of applications they are also considered a best-in-class Financial Management application, according to Gartner, and many growing companies deploy NetSuite as a best-of-breed financial management tool integrated with other leading software vendors (e.g. Salesforce).

Let's get into the NetSuite vs Intacct comparison.

NetSuite meets international statutory and tax compliance with 54+ automatic tax fillings and 19+ languages available in over 200+ currencies.

Whereas, Intacct does not provide reporting in transactional currency and cannot meet statutory and tax compliance requirements outside the US [without a partner].

With NetSuite, consolidations are in real-time, whereas with Intacct, consolidations are batch processed. The GL trial balance is only available in base currency and intercompany journal entries are manual and one-sided.

With NetSuite month end process creates automatic journal entries, closing/adjusting entries, whereas with Intacct month end close process must run adjustments per entity per module manually.

If your business is looking to expand internationally or through acquisitions, NetSuite should be seriously considered over Intacct.

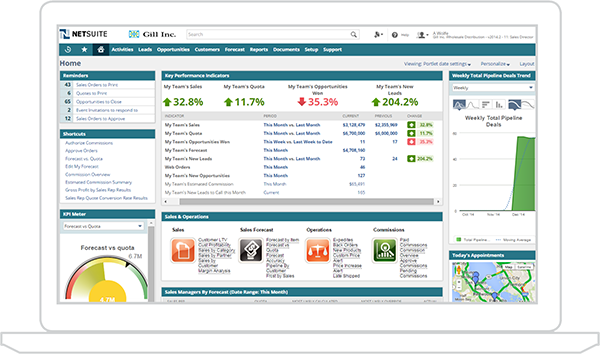

With NetSuite you always know the state of your customers in real-time. On a single screen, you’ll see all contacts, addresses, transactions, opportunities, contracts, entitlement stats, cases, tasks, collections notes, email correspondence and more on any device at any time.

Whereas, Intacct’s customer record is simply a record that stores customer name, a contact, a billing address, and a shipping address. It does not address transactional history or the current state of your customer.

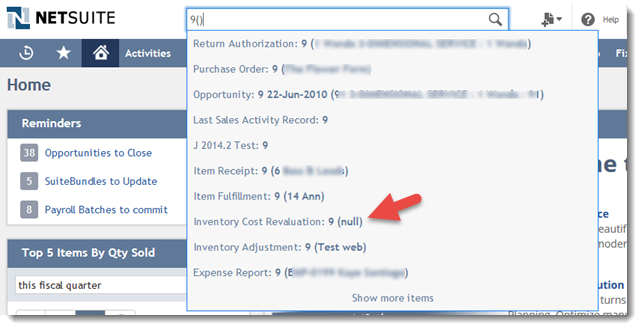

NetSuite’s Global Search allows you to search the entire platform for all records or transactions associated with an alpha-numeric value.

Intacct’s search capability is limited to records that post to the GL, even though there are many important records that do not post to the GL, such as customer records, contracts, opportunities, cases and so much more. Search with Intacct is more clunky and less like Google.

NetSuite helps you understand performance drivers by giving you the ability to drill down into consolidated reports providing complete visibility into source transactions associated with all subsidiaries that make up a consolidated report.

Whereas, Intacct only allows you to drill down to a gigantic consolidation journal entry, which encompasses all transactions for all subs. This prohibits you from seeing the source transactions behind the consolidated report.

But don't just take our word for it. Hear what actual users have to say...

Source:G2Crowd

Getting to customer data and transaction level detail in NetSuite is significantly faster and easier than with Intacct.

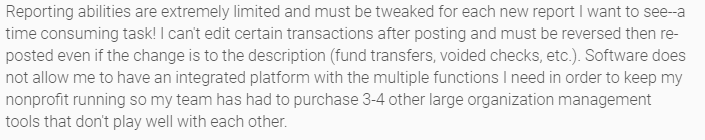

NetSuite provides unlimited reporting capability by providing you with unlimited dimensions and segments. This allows you to capture data, view and report in the format that makes most sense for your business.

Whereas Intacct has only 9 dimensions, limiting your ability to capture and report on relevant business information.

NetSuite gives you a single set of login credentials, which gives you complete access to use NetSuite. You'll use the same credentials to perform daily tasks in NetSuite, or create a support case and access the learning portal.

Whereas Intacct requires you to have three unique sets of login credentials in order to navigate Intacct. You’ll need unique credentials for 1) GL Access, 2) Support, and 3) Learning Portal.

With NetSuite’s flexible platform, end-users can create and define queries, trigger alerts and reminders thereby helping you manage your business processes.

Where as, with Intacct workflows are limited and rigid, requiring you to fit your business processes into predefined workflow. This can make it difficult for business process to evolve and scale.

If you desire a platform that can be customized for your business and processes, NetSuite is better positioned to deliver. Intacct is much more rigid and/or limited when it comes to customizations.

NetSuite’s global consolidation is real-time. By toggling through reporting views, you will see real-time consolidated financials at the global level and regional level and subsidiary level. NetSuite allows you to view subsidiary financials in both functional and translated currencies. NetSuite supports 190 currencies in 160 countries.

But don't just take our word for it. Hear what actual users have to say...

Source: G2Crowd

Whereas, with Intacct global consolidation is not truly real-time. In order to consolidate, you must navigate to a consolidation module and go through a series of screens/clicks to consolidate. Separate reports have to be run for specific subsidiaries, functional currencies & translated currency. You are not able toggle between reporting views, rather you are required to run separate reports.

Here's what an Intacct user had to say about multicurrency...

Source: G2Crowd

NetSuite’s User Interface is supported in 19 languages allowing users to view and use NetSuite in their native language.

Whereas, Intacct's user interface is only supported in English.

NetSuite manages your collections in an automated fashion. System generated dunning emails are sent to customers when invoices become past due. Nothing falls through the cracks and customer responses are captured in NetSuite allowing you to collect faster and more efficiently.

Whereas, Intacct cannot natively provide automated dunning emails and capture customer responses in Intacct.

NetSuite makes it easy to manage your internal controls and segregation of duties effectively and easily using flexible Roles and Workflows.

Whereas with Intacct, adding or editing role permissions/restrictions requires professional service intervention.

NetSuite decouples billing from revenue recognition, alleviating the need to have order entry personnel who also have a extensive rev rec knowledge. Revenue recognition is managed from a revenue arrangement record, whereby rev rec methods and rules are assigned to the arrangement.

However, Intacct forces you to manage revenue recognition at the sales order or invoice. Often, this causes a control issue as those responsible for creating orders and submitting invoices may not have the appropriate accounting background needed to ensure rev rec is accurate.

As part of the period close checklist, NetSuite provides you a list of transactions whereby the GL posting date differs from the transaction date. NetSuite prompts you to review make any necessary corrections prior to close.

Intacct does not offer this sort of functionality.

SuitePayments adds additional capabilities, protecting your customers and eliminates risk as NetSuite has been deemed PCI Compliant by all three major credit card companies. NetSuite is processor-agnostic to avoid lock-in.

Whereas, Intacct partners with 2C Processor. With the Intacct-2C Processor solution, and 2C Processor storing the credit card numbers, it would be difficult and painful for the merchant to switch to another card processor.

Companies that use NetSuite, grow on average 17% faster, than companies that don't use NetSuite.

So, are you looking for a platform for transformative growth? Or do you just need a next-level accounting solution?

The answer to that question depends on your specific needs and business size. NetSuite is a great choice for businesses that are growing quickly and need more robust features, while Intacct is perfect for businesses that are looking for a more robust accounting solution than QuickBooks. No matter which system you choose, make sure to partner with an experienced provider who can help you get the most out of your software investment.

Choosing between top enterprise resource planning (ERP) systems like NetSuite and Business Central can significantly impact a business's efficiency.

NetSuite has become a key player in cloud-based Enterprise Resource Planning (ERP). This platform aids businesses in managing a range of activities...

Managing a business today demands tools that are not only efficient but also adaptable. Cloud ERP systems have emerged as a critical solution,...